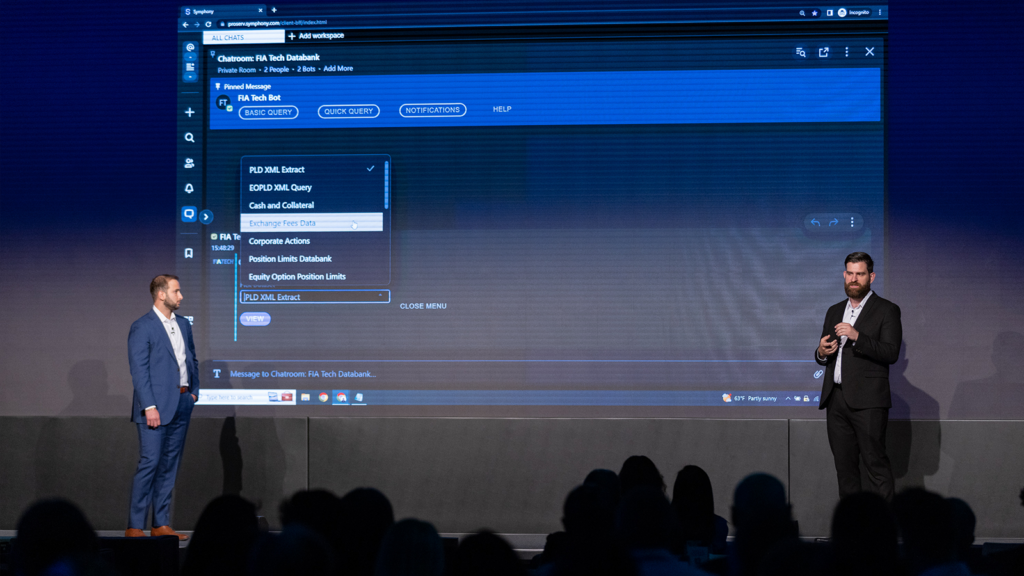

Bringing Speed and Flexibility to Trader Voice: Live Demo of Cloud9

Symphony’s Director of Product Management for Voice, Alex Francisci, and Business Development Senior Specialist, David Murray, demoed Cloud9’s flexible, high-quality trader voice features such as Box-On, Zoom phone integration, and Instant Voice. They were joined by CIC Market Solutions’ FX, IRD & Commodities Trader, Yann Belvisi, to discuss how he is using Cloud9 and Instant Voice today.