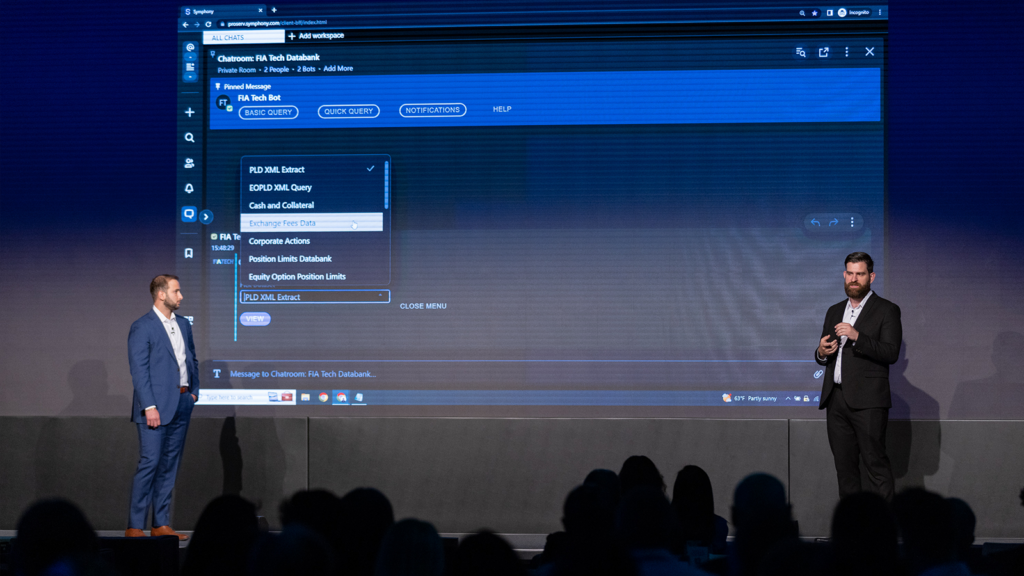

Symphony in the news

Press releases

October 9, 2023

May 9, 2023

Industry Events

Technology and the US Bond Markets

May 2, 2024

New York, NY

Industry awards

2023

AFTAs

Best Comm Infrastructure Init

TabbFORUM Nova

40 Innovators in Financial Markets

Waters Rankings

Best Mobile Solutions Provider

Witad Awards

Support Professional of the Year

2022

American Financial Technology

Best Communication Infastructure

Asian Private Banker Technology

Best Client

FinTech Magazine

Top 100 Leaders

Markets Choice

CEO of the Year

The Fintech 250

Most Promising Fintech Companies

Waters Rankings

Best Mobile Solutions Provider