![[PODCAST] Extracting Voice Data – The Pivot Point in Institutional Trading](https://c9tec.com/wp-content/uploads/2020/11/Cloud9_Podcast_E4_SocialPost_C-1080x675.jpg)

by Cloud9 | Nov 24, 2020 | Podcast, Thought Leadership

Voice trading continues to be a pivotal element of daily workflows across the institutional marketplace, which means that access to greater voice metadata is imperative for strategic, regulatory and operational purposes. In the fourth episode of Cloud9’s podcast series examining developments in the voice trading landscape, Cloud9’s CAO and Head of Partnerships, Brian Hunt, and Verint’s VP of Product Strategy, Phil Fry, examine the who, where, what and why of accessing greater voice metadata and how this will progress as we near the end of one of the most challenging years in recent memory.

![[PODCAST] Fostering greater flexibility in a cloud environment](https://c9tec.com/wp-content/uploads/2020/09/Cloud9_Podcast_E3_SocialPost_B-1080x675.png)

by Cloud9 | Sep 8, 2020 | Podcast, Thought Leadership

As trading tools become more sophisticated, one thing that financial institutions continue to put at the top of their priority list is flexibility in their solutions. While the industry is gaining a greater appetite for working remotely, enabling greater flexibility in a cloud-based environment can still pose challenges. In episode 3 of Cloud9’s podcast series, Cloud9 SVP of Technology & Operations David Midgett and Business Systems Ltd Sales Director Will Davenport discuss how to address some of these hurdles and how the trading landscape will continue to evolve in the months ahead.

by Cloud9 | Sep 1, 2020 | Awards, News

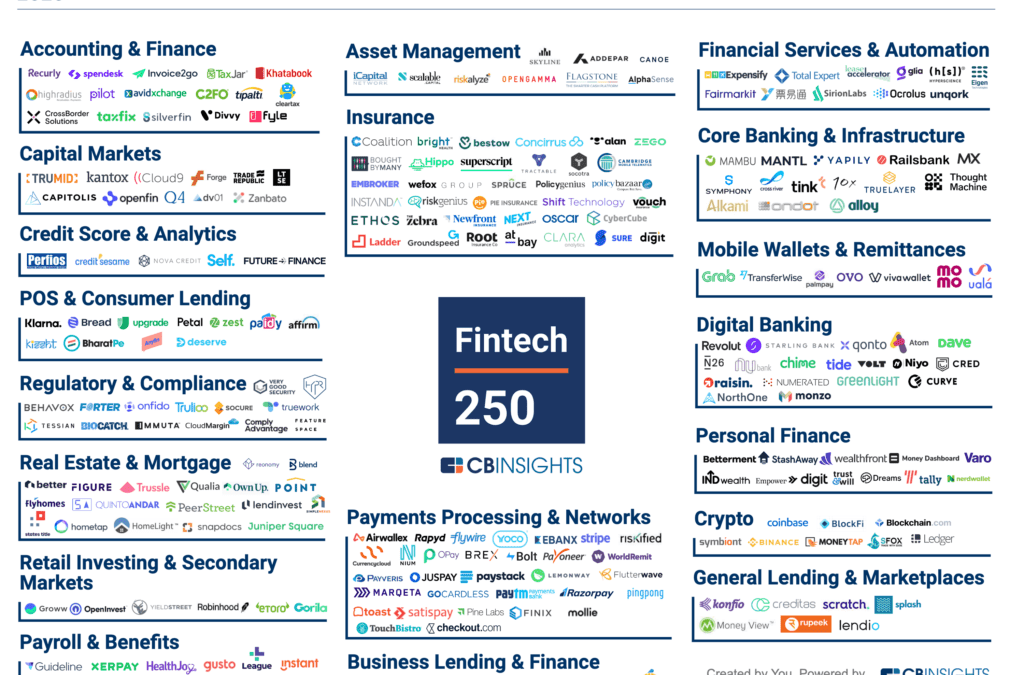

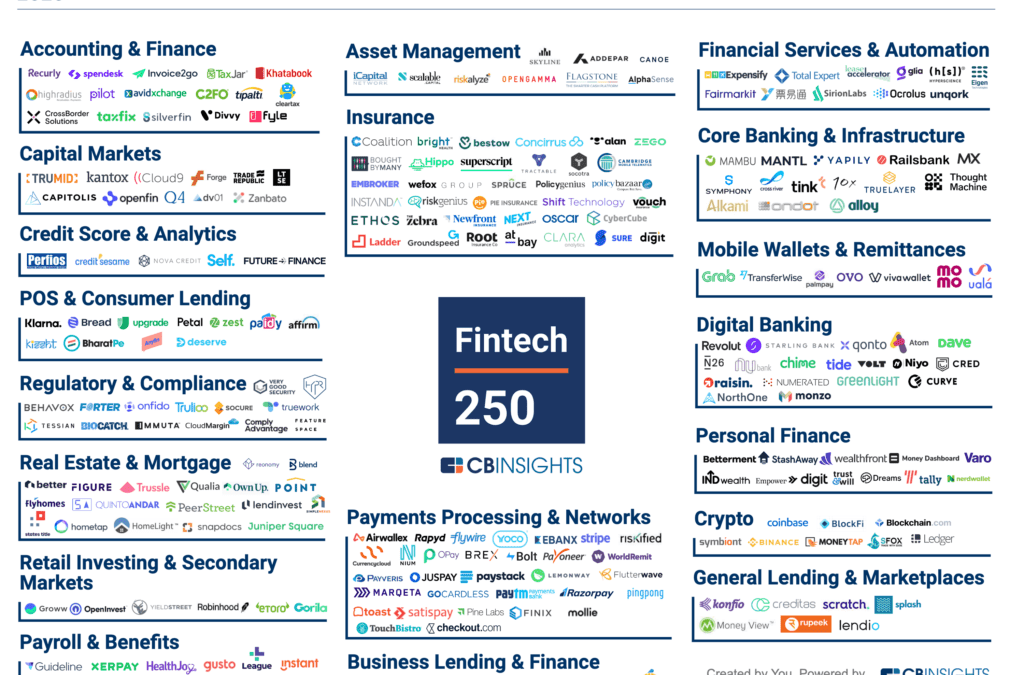

New York; September 1, 2020 – Cloud9 Technologies has been named to CB Insights’ third annual Fintech 250, its ranking of the most promising private financial technology startups in the world. This is the second consecutive time that Cloud9 has been named to the prestigious list, where the Company has been recognized among the best in Capital Markets.

Through an evidence-based approach, the CB Insights Intelligence Unit selected the Fintech 250 from a pool of 16,000 companies, including applicants and nominees, based on several factors. These factors include patent activity, investor quality, news sentiment analysis, proprietary Mosaic scores, market potential, partnerships, competitive landscape, team strength, and tech novelty. The Mosaic Score, based on CB Insights’ algorithm, measures the overall health and growth potential of private companies to help predict a company’s momentum.

“We’re proud to, once again, recognize the 250 best private fintech companies globally. This year’s Fintech 250 represents 25 countries and spans 19 categories — reimagining everything from retail banking and crypto, to insurance and asset management,” said CB Insights CEO Anand Sanwal. “The previous Fintech 250 class raised more than $22 billion in investor financing and saw more than 20 exits after being recognized, and we expect this year’s class will have similar success as they continue to transform how people and businesses spend, save, borrow, and invest their money.”

“The financial technology landscape is evolving rapidly, especially with what has transpired this year and how firms have had to adjust their technology approach and strategy due to the shifting working conditions,” said Jerry Starr, CEO & co-founder of Cloud9 Technologies. “To be recognized among the most innovative fintech companies in the world is a tribute to the fantastic work our team has done this year.”

2020 Fintech 250 Highlights:

- Unicorns: 32 of the 250 companies are valued at or above $1B as of their latest funding round

- Funding trends: YTD, these 250 private companies have raised $10.3B in equity funding across 120 deals (as of 8/26/20)

- Mega-rounds: Since 2019, there have been 87 mega-round ($100M+) equity investments to this year’s Fintech 250, with 35 of them in 2020 YTD (as of 8/25/20)

- Global representation: 46% of the 2020 Fintech 250 are based outside the US. After the US, the UK is home to the most Fintech 250 companies (38), followed by India (20)

CB Insights released its last Fintech 250 in October 2018, where Cloud9 was featured the best in Capital Markets & Institutional Trading.

About CB Insights

At CB Insights, we believe the most complex strategic business questions are best answered with facts. We are a machine intelligence company that synthesizes, analyzes and visualizes millions of documents to give our clients fast, fact-based insights. Serving the majority of the Fortune 100, we give companies the power to make better decisions, take control of their own future, and capitalize on change.

by Cloud9 | Aug 5, 2020 | News, Security & Compliance

NEW YORK, August 5, 2020– Cloud9 Technologies (“Cloud9”), a leader in cloud-based communications, has partnered with comitFS, a UK-based provider of voice middleware and API abstraction capabilities for financial service organizations, to provide more robust real-time call control capabilities for voice trading within the institutional marketplace.

comitFS’s sophisticated mix of trader voice applications and API’s combined with Cloud9’s advanced solutions for voice collaboration and metadata capture allow institutional traders to seamlessly access workflows, whether working remotely or on the trading floor. The collaboration provides normalized Call Data Records that can be easily added to compliance and reconciliation processes.

“As trading dynamics shift to a more digitally-driven environment, firms want the peace of mind that their voice metadata and daily workflows will not be hampered,” said Brian Hunt, Chief Administrative Officer and Head of Partnerships for Cloud9. “Partnering with comitFS makes perfect sense as the industry continues to adjust to a virtual trading environment that will become more prevalent in the months ahead.”

“We have been building specialist voice API’s using open source technologies for our banking clients throughout our seventeen-year history. We are excited to be partnering with Cloud9 to expose their call data records and call control capabilities to our common customers,” said comitFS CEO and Managing Director Jappy Takhar.

comitFS is the only provider of specialist voice middleware to tier-one banks that tightly integrate their in-house and third-party applications, such as Salesforce’s CRM to report on real-time voice calls and Client voice interactions. This collaboration between Cloud9 and comitFS will offer for the first time its voice middleware in the cloud and it will work seamlessly with on-site setups for call control, CDR reconciliation, and meeting compliance regulations.

Through this collaboration, Cloud9 and comitFS allow financial institutions to address the data storage, workflow, and trade reconstruction rules stipulated under key regulatory mandates and directives such as MiFID II.

About Cloud9 Technologies

Cloud9 Technologies is the leading voice communication and analytics platform designed for the unique needs of the financial markets. Cloud9 developed a solution that harnesses the voice communication talk path for the trading floor of the future – offering more functionality and analytic insight than legacy hardware at a fraction of the cost. Cloud9 connects counterparties across all asset classes via a cloud-based communication platform that eliminates the infrastructure and expense associated with legacy hardware and telecommunication-based solutions, with front-office focused data and transcription, purpose-built for the financial markets. For more information, visit www.c9tec.com.

About comitFS

comitFS is an independent firm dedicated to providing blue-chip institutions with better financial markets communication technology. Founded in 2003, comitFS developed the leading-edge ”Communication Application Server” (CAS) Middleware specifically to solve the complex challenges of trader communication. CAS underpins a suite of solutions and services from “build” to “support” across – Communication & Collaboration, Regulation & Compliance and Refresh & Transformation of the Communication infrastructure. The Company has offices in New York, London, Singapore, and Switzerland. For more information, visit https://www.comitfs.com/.

MEDIA CONTACTS

For Cloud9:

P.J. Kinsella

EVP, Media Relations, Paragon Public Relations

pj@paragonpr.com

+1.973.255.7153

For comitFS:

Ashley Francis

Head of Sales, comitFS

afrancis@comitFS.com

+44(0)7786 118102

![[PODCAST] Navigating compliance parameters and cloud security across the increasingly virtual voice trading environment](https://c9tec.com/wp-content/uploads/2020/07/Cloud9_Podcast_E2_SocialPost_C-1080x675.png)

by Cloud9 | Jul 31, 2020 | Podcast, Thought Leadership

The institutional marketplace is gravitating towards a more digitally-advanced ecosystem which is requiring greater technology sophistication and, in turn, more stringent data security and regulation parameters. As traders become more comfortable working remotely, accessibility to robust sets of voice metadata for both strategic and regulatory reporting purposes will be very important. In Episode 2 of the Cloud9 podcast series, Cloud9 CTO and Co-Founder Leo Papadopoulos and SteelEye CEO Matt Smith discuss how the partnership that their companies recently announced addresses these concerns and why it’s so important for firms to equip themselves with the proper security and regulatory reporting tools during this transitional period.

Cloud9 Technologies · Navigating compliance parameters and cloud security across the virtual voice trading environment

![[PODCAST] Extracting Voice Data – The Pivot Point in Institutional Trading](https://c9tec.com/wp-content/uploads/2020/11/Cloud9_Podcast_E4_SocialPost_C-1080x675.jpg)

![[PODCAST] Fostering greater flexibility in a cloud environment](https://c9tec.com/wp-content/uploads/2020/09/Cloud9_Podcast_E3_SocialPost_B-1080x675.png)

![[PODCAST] Navigating compliance parameters and cloud security across the increasingly virtual voice trading environment](https://c9tec.com/wp-content/uploads/2020/07/Cloud9_Podcast_E2_SocialPost_C-1080x675.png)