Fortifying Your Financial Cybersecurity

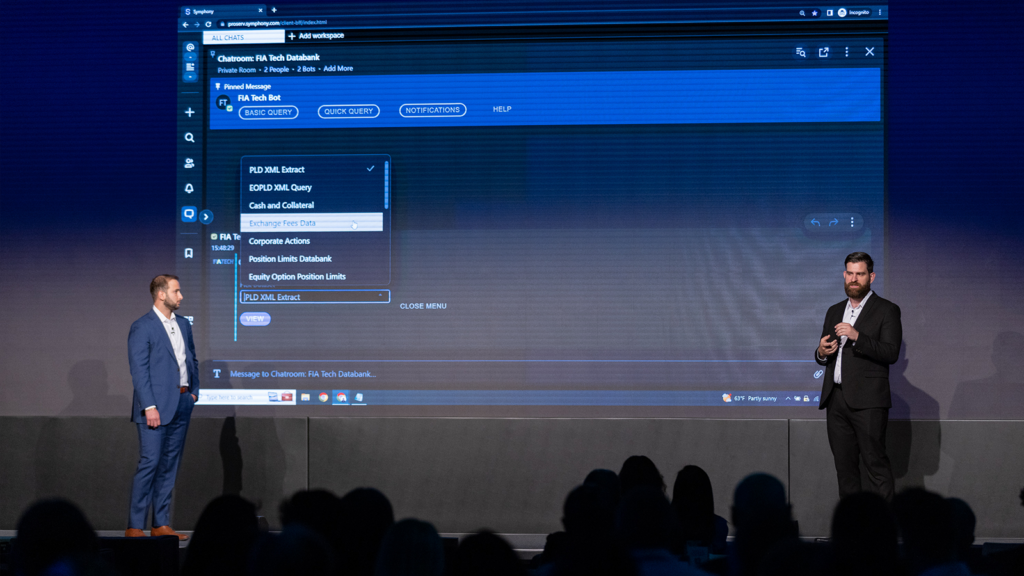

Data security and regulatory controls grow more important every year, due to increasingly sophisticated hacking groups, generational shifts in technology and the massive financial fines imposed by the regulators in cases of non compliance with data-handling requirements. The pressure is on for trusted partners that deliver robust data security that prioritizes cryptographic protection, offers purpose-built security solutions, and fosters a culture of collaboration and transparency.